Small businesses often need access to funding to grow, whether it’s for purchasing new equipment, expanding operations, or managing cash flow. However, traditional lending options can feel out of reach due to higher requirements or perceived risks.

That’s where the U.S. Small Business Administration (SBA) steps in, offering a gateway for businesses to secure funding.

This article will explore how small businesses can work with the SBA to access capital through a variety of loan programs, ensuring they can meet their financial needs efficiently and effectively.

What are SBA loans?

SBA loans refer to loan programs supported by the U.S. Small Business Administration. Rather than directly lending money, the SBA partners with approved lenders to guarantee portions of loans, reducing the risk for lenders and making it easier for small businesses to access funding. From startups to established businesses, these loans cater to diverse financial needs while offering attractive terms and additional resources.

Benefits of SBA Loans

- Competitive Terms: SBA-backed loans typically come with favorable interest rates and fees.

- Flexible Options: Options like reduced down payments, longer repayment terms, and no collateral requirements for some loans.

- Counseling and Education: Many SBA loans come with free access to professional guidance on business planning and management.

These advantages make SBA loans a strong alternative to conventional loans for small business owners.

Key SBA Loans for Small Businesses

The SBA offers several loan programs tailored to different business situations. Below are the most notable options:

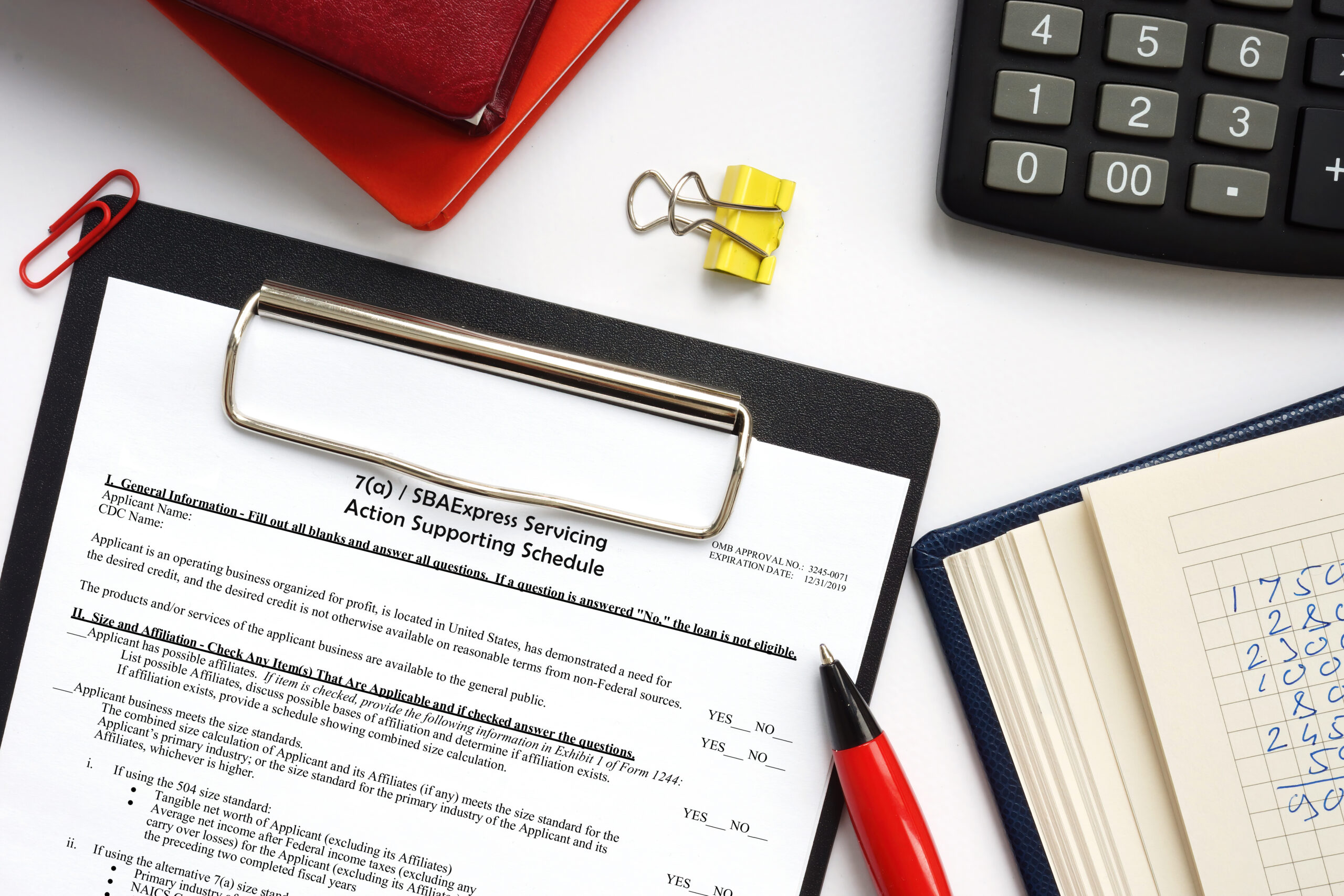

1. 7(a) Loans

The 7(a) Loan Program is the SBA’s flagship offering, designed to provide general-purpose funding. Businesses can use these loans to purchase equipment, expand facilities, or cover working capital. Loan amounts can reach up to $5 million, with flexible terms negotiated between the business and the lender.

2. 504 Loans

The 504 Loan Program offers long-term, fixed-rate financing primarily for purchasing fixed assets such as real estate, machinery, or construction. These loans are administered through Certified Development Companies (CDCs), which partner with lenders to provide financing up to $5.5 million.

3. Microloans

For those needing smaller funding amounts, microloans are an excellent option. These loans, capped at $50,000, are ideal for startups or nonprofit childcare centers requiring funds for inventory, supplies, or small-scale equipment.

4. Export Loans

If your business is involved in international trade, SBA export loans can help you manage day-to-day operations, fulfill large supplier orders, or refinance trade-related debt. Export loans reduce the hurdle of acquiring financing for businesses operating in global markets.

Eligibility Requirements for SBA Loans

While specific eligibility requirements vary by loan type and lender, general qualifications for SBA loans include the following:

- Business Registration: Your business must be legally registered and operating within the United States or its territories.

- Size Standards: The SBA requires businesses to meet its size standards, typically based on the number of employees or annual revenue.

- Sound Credit: While bad credit does not disqualify applicants outright, lenders assess the ability to repay the loan. Businesses must have credit scores and documentation to support their financial reliability.

- Unavailability of Alternative Lending: Applicants must demonstrate the need for SBA-backed loans due to limited access to standard commercial loans with reasonable terms.

For accurate guidance on your eligibility, consult with an SBA-approved lender.

How to Get Started with SBA Loans

If you’re considering applying for an SBA-backed loan, follow these steps to ensure a smooth process:

1. Research loan programs.

Familiarize yourself with the different types of SBA loans and identify the one that aligns best with your business needs.

2. Use the SBA’s Lender Match tool.

The SBA’s Lender Match tool connects you with approved lenders suited to your business requirements. Input basic information about your needs, and the tool will match you with lenders within two days.

3. Submit your application.

Once matched with a lender, create an account and begin discussing your loan. Provide necessary documentation, including financial statements, tax returns, and a detailed business plan for the lender’s review.

4. Review and secure your loan.

Work closely with your lender to finalize loan terms. Once approved, you’ll receive funding to execute your business goals.

Safeguarding Against Predatory Practices

When seeking funding, beware of predatory lending practices. Warning signs include:

- Unusual interest rates significantly above industry averages.

- Fees exceeding 5% of the loan’s value.

- Pressure to complete applications or sign agreements prematurely.

To protect your business, consider consulting with a financial advisor or legal counsel before committing to a loan.

Closing Thoughts: Grow Smarter with SBA Loans

Accessing capital doesn’t have to be a barrier to growing your business. SBA loans provide small business owners with diverse funding options, offering competitive terms and robust support. From startups to established enterprises, you can leverage these loans to drive growth, expand opportunities, and achieve your goals.

Whether you’re looking for general funding or need specific financing for real estate or exports, the SBA has a loan program designed for your needs.

Get started today by visiting the SBA’s loan page. If you’re ready to explore your funding options, use the SBA’s Lender Match tool to connect with approved lenders and take the first step toward growing your small business.